A post-pandemic push to diversify international enrolments

- A new report highlights 17 global markets for their potential in helping institutions and schools to build more diverse enrolments

Institutions and schools have given greater attention over the last decade to the need to build diverse international enrolments. Even so, enrolments remain fairly concentrated in many leading study destinations across a narrow band of sending markets. The pandemic, however, has drawn a sharp line under the diversification strategies of many recruiters and we can anticipate an even greater push going forward to rebalance the enrolment base, and to build student numbers in key emerging markets.

Our earlier analysis in this area has identified distinct bands of growth markets, with Vietnam, Colombia, Indonesia, Nigeria, and Iran in the top tier on the basis of their projected long-term impact on student mobility. We have also identified a second tier of important, emerging markets, each of which is also poised for substantial growth: Bangladesh, Nepal, Ghana, Kuwait, and Egypt. African markets feature in each of those top bands, and we have considered separately as well the tremendous potential of markets throughout the continent.

Each of those countries is projected to play a greater role in driving global student mobility this decade and next, and each in turn shares some key demand-side characteristics that will fuel that outbound growth. In particular:

- A large population base and especially a youthful population poised for further growth

- Rapidly expanding middle class populations

- High-performing economies with above-average growth rates

- Significant demand-supply gaps with respect to domestic higher education provision

A recent study from Studyportals and Unibuddy brings many of these underlying features into sharper focus to identify 17 high-potential markets for student recruitment. Many of these are found in the high-growth tiers we have described above, but the Studyportals/Unibuddy report sets a different framework for organizing and prioritising markets for diversification.

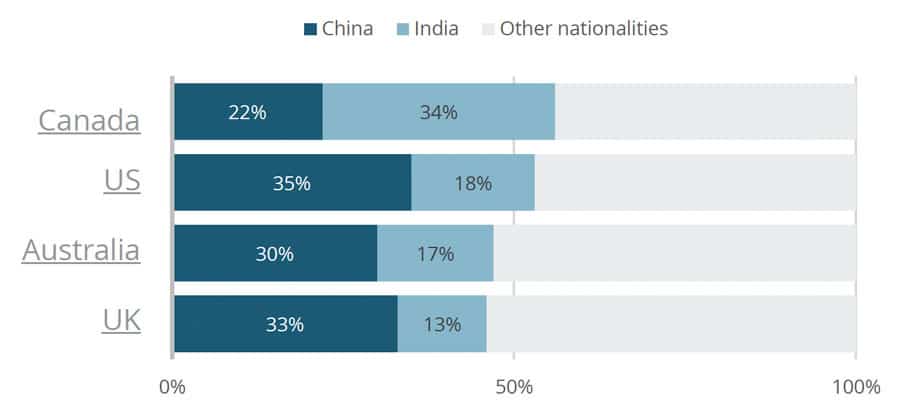

It begins by highlighting the high degree of reliance that some of the world's leading study destinations have on two key sending markets: China and India. As we see in the chart below, the US, UK, Australia, and Canada all rely on those two countries alone -- albeit in varying proportions – for roughly half of their foreign enrolment base.

The paper sets out as well the business case for diversification, namely that it helps institutions and schools to balance and manage risk, and to improve the student experience in the process. "A diverse classroom mitigates risk, but more importantly, it drives education quality and prepares students for a global world," says Studyportals CEO Edwin van Rest. "Diversification is a cornerstone of international higher education.”

Taking that acute reliance on China and India as a starting point, the report introduces a framework for moving "Beyond India" to consider a series of emerging South Asian markets and "Beyond China" for a corresponding set of target markets in Southeast Asia.

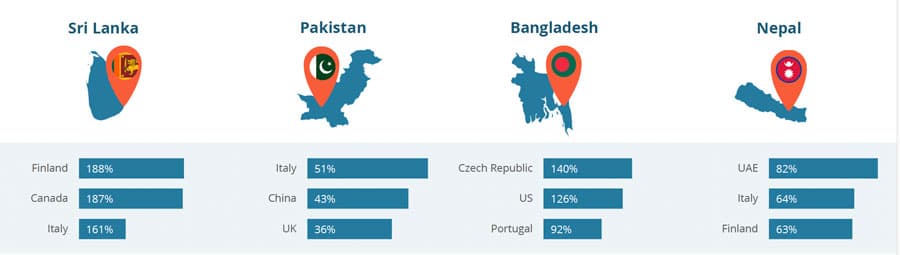

Those South Asian markets are distinguished by their huge populations, and include Pakistan, Bangladesh, Sri Lanka, and Nepal. As the report notes, "Relatively young, populous and in need of high-quality higher education, the countries neighbouring India can create powerful synergies with universities open to international students. Their main resource lies in their demographics: the cohort of 15-24-year-olds is growing, offsetting the general ageing trend of Asian societies."

Similarly, the highlighted markets in Southeast Asia – Vietnam, Thailand, Philippines, Malaysia, and Singapore – are noted for their growth potential as well as the diversity of students' interests in terms of field of study. "The countries in South-East Asia are among the fastest growing countries on Studyportals’ platforms, with Thailand and Vietnam booming in interest for full-time study options abroad. The region, however, offers a lot of diversity: Vietnam and Thailand already reached their peak in the 15-24 age cohort; while Malaysia and Singapore’s more modest numbers are stable; and the Philippines’ study-age population keeps rising."

As those varied scenarios suggest, the "right" answer in terms of target market will vary from institution to institution, according to established strategic priorities, current engagement in the region, and the programmes and services on offer for international students. For those prioritising based on long-term growth, however, each of those country sets will certainly offer some clear and compelling choices.

The report additionally profiles eight more markets in Europe and elsewhere that are noted for their recruitment potential. Not all could be classed as new or emerging markets for most recruiters, but the Studyportals/Unibuddy analysis nevertheless offers some interesting insights for a number of markets, including Poland, Romania, Turkey, and Ghana. As Unibuddy CEO Diego Fanara puts it, "A university’s best-fit students don’t only exist in the regions they most frequently recruit from—they’re everywhere. When institutions prioritize diversification in their recruitment efforts, they build stronger, more talented communities.”

For additional background, please see: