Survey reveals important shifts in student decision making

“Student mobility is … likely on the precipice of transformation,” conclude the authors of the 2018 QS Applicant Survey Report, with two trends significantly altering the landscape of international education: (1) a less welcoming policy environment in the leading two destinations, the UK and the US, and (2) an increased willingness among students to consider alternative destinations – especially Canada, as well as Australia for students in the Asia Pacific region. Without doubt, the 2018 instalment of the QS survey, which “aims to locate university applicant motivations and study decisions in the contemporary political and economic context,” occurs at a time of some important shifts in the industry and in the world in general, with Trump and Brexit on the minds of virtually everyone, including students. The survey shows that while the US and UK remain applicants’ top choices for study abroad, these destinations are losing ground in important source regions. The survey authors attribute this pattern in part to “restricted freedom of movement and immigration control” in the US and UK. The survey was taken amid the 2016/17 academic year, and its data represents 16,560 responses, 6,715 of which were from applicants interested in undergraduate programmes, 6,610 who were interested in master’s courses, and 1,370 from those intent on pursuing a PhD.

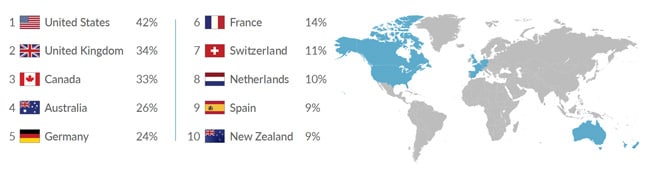

The US and the UK remain top choices

Overall the US remains the most preferred study destination (48%) and the UK second (42%). Canada is quickly rising as an attractive destination (34%), and Australia and Germany round out the top five (both 28%). Though the US remains #1, the current administration’s moves to discourage Muslim peoples’ travel and immigration to the US are having an impact in countries where there is the greatest potential for students to be negatively affected. For example, QS reports that,

- “In Iraq the US has fallen from 1st to 4th most popular country preference;

- In Libya, the US has dropped from 1st to 3rd;

- In Sudan, it has dropped from 2nd to 3rd;

- In Iran, it has dropped from 1st to 3rd;

- In Somalia, it has dropped from 1st to 3rd.”

The US has gained ground in one region, however: Eastern Europe, likely because of applicants’ concerns about Brexit and how it would affect them if they applied to the UK, and/or because of a more general sense that Britain is less welcoming to international students and immigrants than in the past. The US replaces the UK in this region as the top choice of applicants for the first time in the survey’s history. The UK has also become less popular in the Asia Pacific region, falling from first to fourth place and replaced by Australia in second place and Canada in third. The report authors conclude that,

“This year’s results reveal alternative English-speaking destinations are rising in the ranks of preferred study destinations. Canada remains the third most-popular study destination, and in many cases, outperforms the UK and the US when target destinations are broken down by country, especially in the Middle East region. Worldwide, Australia replaced Germany in fourth place and New Zealand jumped up two positions from twelfth to tenth. This could indicate that students who previously would have chosen the US or the UK are now actively considering Australia and Canada as suitable alternatives.”

Drilling down into regional preferences

Among Eastern European applicants, the US (40%) is now slightly more popular than the UK (37.5%). Next are Germany (33.5%), Canada (25%), and the Netherlands (22%). France has dropped from 4th place to 8th, while Canada, the Netherlands, Sweden, Norway, and Austria have all moved up. In Western Europe, the UK is far and away the top choice, with 6 in 10 (59%) preferring it above all other choices. Next in line are the US (36%), France (22%), Germany (22%), and Canada (20.5%). Canada edged out the Netherlands in the 2018 survey to make it into the top five. Latin American applicants rank the US first (52%) and Canada second (43.5%), with Canada replacing the UK (41%) in this position. Australia (32%) and Spain (30%) round out the top five, in a reversal of their positions last year. In North America, the US is again tops, with nearly three-quarters (74%) choosing the US and its highly ranked institutions. Much further back is Canada (25%), the UK (21.5%), France (11.5%), and Spain (8%). Spain replaces Germany this year in the #5 spot, which the report authors suggest is likely linked to the large number of Spanish speakers in the US. Notably, Asia is gaining traction as an attractive region in which to study:

“Other than applicants from Asia Pacific itself, applicants from the US and Canada show the greatest inclination to consider study destinations in Asia. Looking at the top 20 preferred countries, most regions selected only one or two countries in Asia, while American and Canadian applicants chose four: Hong Kong, China, Singapore and Japan.”

In Africa and the Middle East, the US retains its #1 position but not by much: Canada replaces the UK in second position and is virtually tied with the US (37.6% versus the US’s 37.8%). After the UK, France and Germany round out the top five. Notably:

“For the first time, China appears within the top 10 list of study destinations for students in this region, emerging as the eighth most popular destination. This is significant, given that last year China did not even make it into the top 20 preferred countries for applicants from Africa and Middle East. Moreover, participants from this region cite China as a preferred study destination more than any other region surveyed (9.1%).”

In Asia Pacific countries, the US remains in top place (40.5%), but not far behind are Australia (32.5%), Canada (32%), the UK (31%) and a little further back, Germany (26.5%). Of particular note, the UK’s position fell from second to fourth place, the greatest drop for the UK of all the regions.

Funding a key influencer

The survey looked not only at preferred destinations but also at a range of other factors important to applicants to higher education programmes. One research area was determining the extent to which funding matters to students. With 70% of PhD applicants, 60% of master’s applicants and 57% of undergraduates saying that the availability of funding attached to a programme is the leading factor in their choice of institution, it follows that the presence of financial aid/scholarships plays a major role in overall mobility trends.

Students anticipate pursuing more than one degree

Students are increasingly considering further study even as they apply for a degree at one level. “Among master’s applicants, the most popular reason for pursuing their chosen programme was to progress to a higher-level qualification,” observe the report authors, continuing that “an increasing share of applicants believe a single degree will no longer be enough to secure employment.” This motivation is also prevalent among undergraduate applicants.

Motivations across the three levels of study

In general, PhD candidates pursue study at this level because of a desire to pursue a life in academia. Students looking to study at the master’s level are the most likely of all students to be interested in furthering their own business and progressing in their career path. Meanwhile, students at the undergraduate level are the most likely to be interested in programmes that will allow them to enter a particular profession.

Priorities among undergraduate applicants

In Africa and the Middle East as well as in Eastern Europe, employability is the top concern for undergraduate applicants, with “progress in my current career path,” “requirement to enter a particular profession” and “employment prospects” the most commonly cited study motivations. Meanwhile, in Western Europe, undergraduate applicants place a higher priority on their chosen programme being linked to “personal interest” than applicants in any other region, with fully half of Western European students saying this is the most significant factor in their decision. The report authors suggest that greater economic prosperity and low/no tuition in certain Western European countries allow students to choose programmes less on the basis of “necessity” (i.e., the need for money or a job) and more on the basis of what fascinates them. Latin American students are also driven by personal interest, and they are the most likely to prioritise “opportunities for cultural exchange” in their decision-making process. The report notes “striking similarities” in the motivations of Asian Pacific, American, and Canadian students, with “career progression, personal interest, and professional choices” the top factors governing study abroad decisions. Relatedly, Americans and Canadians were more likely than any other nationality to say an influential factor in their decision to study is that their employer required them to do so.

The big picture

QS Market Insights Manager Dasha Karzunina, who authored the survey report, said: “With top student destinations remaining relatively stable over the last few years, it is interesting to see student preferences change this year, particularly in the context of the recent geopolitical events in the US and the UK.” That Canada is virtually tied with the US among African and Middle Eastern applicants for most preferred destination – and ahead of the UK – is a major finding, especially given the potential of emerging markets in the region. Equally notable is the UK’s slip in Asia Pacific, home to the world’s largest sending markets and several important emerging economies. Asia Pacific is also a region where student mobility flows are rapidly changing in general. With its rising middle class populations and increasing higher education capacity and quality, study destinations within the region are increasingly attracting students who might otherwise have ventured further afield, and closer cooperation and growing commercial and political links among countries in the region will only accelerate this trend. The QS survey joins a growing body of research suggesting that much change is afoot in international student mobility patterns, and we are only seeing the beginning of a new, more competitive landscape. For additional background, please see: