Data shows a decline in Nigerian student searches for study abroad; UK may be hardest-hit

- Data show that Nigerian demand for study abroad is falling in part because of the troubled Nigerian economy

- The UK is experiencing the most significant decline, entailing serious risk for universities in the country

- Nigeria is the UK’s third largest student source market, and Canada’s fourth

Nigeria has been one of the most important new sources of students for leading study destinations worldwide in recent years. But it has become an increasingly high-risk market due to internal macro-economic turmoil including the depreciation of the Nigerian naira, which has made study abroad more expensive for prospective Nigerian students.

Data shows the turbulent nature of the market

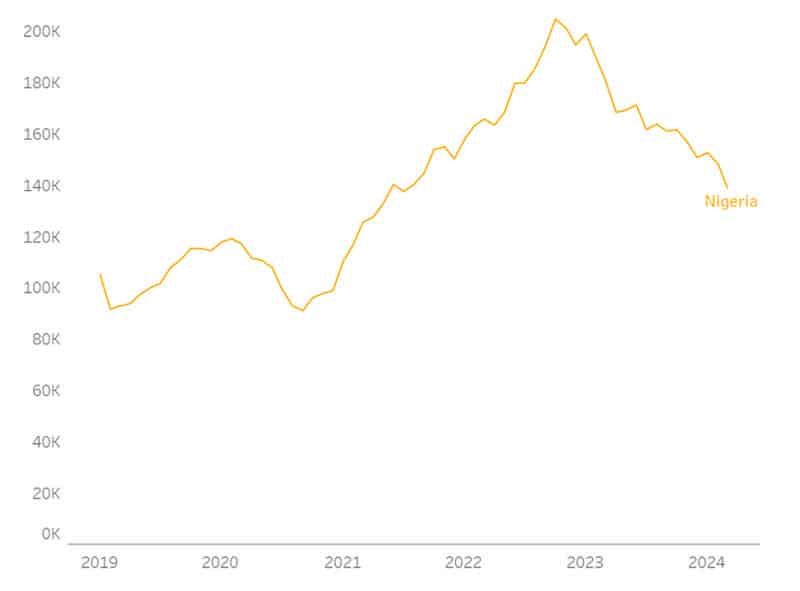

The chart below, based on pageview data across Studyportals websites over time, shows that Nigerian student interest in study abroad rose dramatically between 2021 and 2023, then began dropping, with a significant decline noticeable at the end of 2023 and through the first months of 2024.

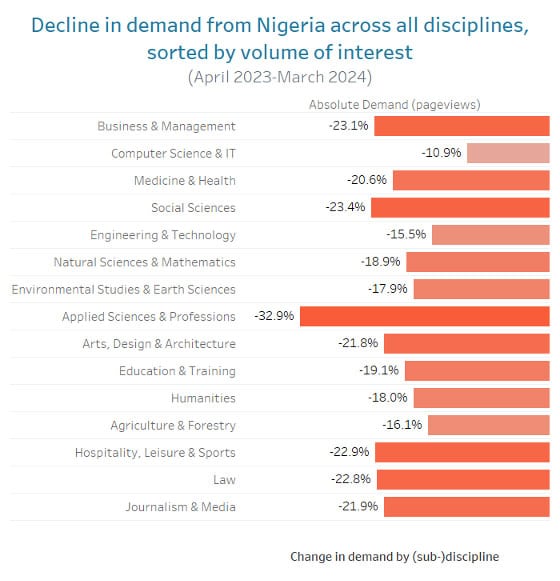

Studyportals data shows a marked decrease in Nigerian activity on their platform for all disciplines in March 2024 compared with April 2023. The study fields most affected are Business & Management (-23%) and Applied Sciences (-33%).

Studyportals points out: “As Nigeria is the 4th top source country by volume of student interest for bachelor’s and master’s programmes, this decline is bound to create challenges for universities.”

UK universities the most exposed to risk from falling Nigerian demand

In terms of risk from current trends in Nigerian student demand, UK universities are arguably the most exposed, as (1) they have relied greatly on Nigeria for overall international enrolment growth and (2) a new policy enacted by their government is already having a profound effect on Nigerian student applications.

That policy, which went into effect in January 2024, prevents the family members of international students, other than those in postgraduate research-oriented programmes, from entering the UK on a sponsored study visa. Not coincidentally, there was a 44% decrease in sponsored study applications to the UK in the first three months of 2024 versus those same months in 2023.

Between 2017/18 and 2021/22, the number of Nigerian students in the UK grew from 10,685 to 44,195, a 314% increase and the second highest rate of growth after India (517%). Last year, Nigeria was the third largest market for the UK after China and India.

Particularly popular among Nigerian students have been one-year taught master’s programmes in the UK – but these programmes no longer allow international students to bring their dependants.

In 2022, almost half (45%) of all dependant visas were issued to Nigerian students, while Indian students claimed the next largest share (29%).

Studyportals data shows that Nigerian demand for the UK is down more than it is for other destinations, and Studyportals notes the impact of policy on this trend:

“While the average decline in interest from Nigeria, for the US, across the top 100 subdisciplines for is -12%, for the UK, it is -53%. The decrease is likely linked to the new British government policy that has banned dependent visas, and the announcement of a review of post-graduation work visas. This, combined with the economic struggles that Nigeria is currently facing, has made it quite difficult for Nigerian students to consider studying in the UK, which can be seen in the 76% decrease in visa issuances that has been noted in January 2024 by Enroly Data Insights.”

In terms of absolute Nigerian student demand (Studyportals page views) between April 2023 and March 2024, these are the trends in the destinations hosting the largest numbers of Nigerian students:

- UK: -55%

- Canada: -12%

- US: -13%

- Germany: -7%

- Australia: -21%

Once again, it’s interesting to look at policies when observing the differences between the above declines. Nigeria is now Canada’s fourth largest market (45,965 students), up 322% since 2017. This growth rate suggests that Canadian institutions are definitely vulnerable to the macroeconomic issues challenging Nigerian students’ families. But at the same time, they may gain a competitive edge in Nigeria because of two new developments in Canadian immigration policy:

- The length of work permits for international students graduating with master’s and other advanced degrees is increasing to three years;

- Dependants of international students at the graduate level remain eligible for open work permits (unlike those at the undergraduate level).

What’s more, the study permit approval rate for Nigerian students applying to Canada doubled from 2020 to 2023 to 40%. This is still lower than the average of 60% across all international student applicants, but the doubling will not have gone unnoticed in Nigeria.

Germany, which also experienced a lower relative decline in Nigerian student interest on the Studyportals platform (-7%), has recently increased in-study work rights and is aiming to double the retention rate of foreign graduates by 2030.

As for Australia (-21% in student interest), it is possible that news of record-high visa rejection rates is circulating in Nigeria as it seems to be in Southeast Asian countries. But Nigeria is only Australia’s 32nd largest student market (under 3,000 students), and thus Australian educators are less exposed to risk from this market.

The US policy climate as it relates to international students has been stable in 2024, though as in Australia, visa rejection rates have been surging. Still, IIE data for 2022/23 show that the number of Nigerian students in US colleges and universities grew to 17,640, up 22% from the previous year, and IDP Education shows that the US has moved ahead of the UK, Australia, and Canada as the most preferred destination among international students.

For additional background, please see:

- ICEF Africa: Get the latest market intelligence and meet a large selection of potential student recruitment partners from across the African continent.

- "Nigerian economy shows its strength but the national currency is struggling again this year"

- "New report highlights the increasing competition for international students from Sub-Saharan Africa"