Vietnam remains a key growth market in Southeast Asia

- Vietnam ranks in the top 10 markets in the world in terms of outbound student mobility

- Persistent quality issues in the domestic education system, an expanding middle class, and increasing tuition fees charged by international schools are driving Vietnamese families to send their children abroad

- Demand is increasing especially at the K-12 level of schooling

- TNE activity is also intense in Vietnam, and the e-learning market is growing quickly

The drive among Vietnamese families to send their children abroad remains very strong in 2023. Vietnamese parents have always been drawn to English-speaking study abroad destinations because of the edge English proficiency provides their children interviewing for jobs. However, as Western hegemony weakens and more global economic power has shifted to the East, Vietnamese students are widening the range of destinations they consider for study abroad.

For example, South Korea and Japan now host the greatest numbers of Vietnamese students in terms of overall enrolments (i.e., across levels and sectors, including language learning). According to Vietnam-based agent Capstone Education, South Korea is the top host (enrolling 66,000 Vietnamese students in 2022), and Japan is second with just over 49,000 in 2021 (consistent with the figure provided by Study in Japan. However, the Korea Educational Development Institute (KEDI) counts only 37,490 Vietnamese students in Korea in 2022; according to the KEDI count, Japan is the top destination, followed by South Korea.

After that, top enrollers of Vietnamese students are as follows:

- US: 29,742 (2022 as per SEVIS)

- Australia: 21,315 (as of the latest Australian government figures consulted June 2023)

- Taiwan: 20,000 (as per 2022 Taiwanese government figures)

- Canada: 16,140 (2022)

- New Zealand: 13,475 (2022 as per Education New Zealand)

- China: 12,000 (2020 and 2021 according to the Chinese government)

Singapore, Germany, the UK, France, Finland, Ireland, and the Netherlands also host significant numbers of Vietnamese students.

Vietnam ranks in the top 10 student source markets for:

- Australia: #5

- Canada: #8

- Japan: #2

- New Zealand: #4

- South Korea: #2

- The US (#6 overall, #5 for K-12, #2 for community colleges)

- Taiwan (#1)

The latest UNESCO data indicates that 132,560 Vietnamese students were enrolled in higher education abroad in 2020. But Vietnamese students contribute to many other sectors, including K-12, non-degree, and language learning.

The Vietnamese Ministry of Education and Training (MoET) says there were about 190,000 Vietnamese students studying abroad in the 2019/20 academic year, while other sources estimate more than 200,000 abroad.

Looking at the data we’ve noted so far – the enrolments, the prominence of Vietnam in top 10 sending countries for so many destinations, the hundreds of thousands of Vietnamese currently studying abroad – it’s already apparent why Vietnam is a hot zone for recruiters across all world regions.

But that’s not all. Consider the following demographic indicators:

- More than a quarter (28%) of Vietnam’s population is between the ages of 16 and 30 and the higher education system is strained in terms of capacity.

- More than 20 million Vietnamese are aged 5–19.

- And from INTO: “Vietnam has the fastest growing middle class in Southeast Asia … and the tertiary enrolment rate has increased from 10% in 2001 to 29% in 2019.”

What are the push factors?

Education is a top-of-mind concern for families across Vietnam. In 2018, HSBC determined that spending on education accounted for 47% of the total household expenditure in the country. Vietnam’s English-language daily, Vietnam News, puts the national preoccupation with education this way: “Vietnamese families have maintained an age-old tradition of scrimping on everything else except education.”

But Vietnamese families have long lamented the state of their education system, and it’s been said that the poorer a Vietnamese family is, the more determined they are to send their children abroad.

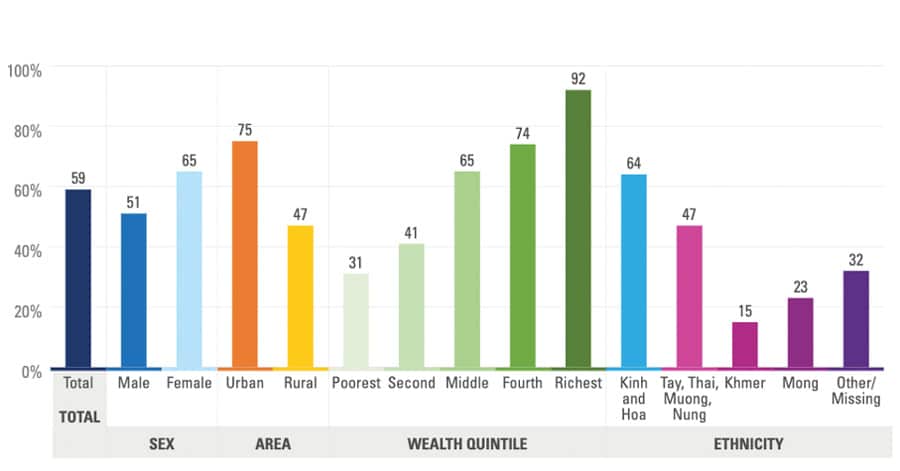

Teacher shortages are a serious problem in many cities and regions and families in rural areas are frustrated by limited access to quality education. As the following chart from UNICEF shows, upper secondary completion rates vary dramatically according to region and income bracket.

Families are motivated by a goal of lifting their children out of poverty and limited job prospects. Vietnam’s informal economy (aka “shadow economy” – jobs that aren’t taxed or monitored by government) accounts for 20.5% of GDP, and the informal sector has been growing in recent years in contrast to a downward trend in comparable countries.

At the same time, Vietnam is also a success story according to many criteria, and an expanded middle-class means that many more families can afford to send their children abroad. The World Bank says:

“Economic reforms since the launch of Đổi Mới in 1986, coupled with beneficial global trends, have helped propel Vietnam from being one of the world’s poorest nations to a middle-income economy in one generation.”

The World Bank notes the following achievements:

- Between 2002 and 2021, GDP per capita increased 3.6 times, reaching almost US$3,700.

- Poverty rates (US$3.65/day, 2017 PPP) declined from 14 in 2010 to 3.8 percent in 2020.

- Vietnam’s average duration of (learning-adjusted) schooling is 10.2 years, second only to Singapore among the Association of Southeast Asian Nations countries.

In 2023, both poorer and wealthier Vietnamese families are upset about rising tuition costs in their country – costs that make study abroad an even more attractive option. The government announced an intention to raise tuition fees in 2022/23 “to respond to the aspiration for better teaching and learning quality,” but also noted that the effect of COVID on families’ wealth had prompted “many localities have to keep, or even waive, their tuition fees at the general education level for the 2022–23 school year.”

Demand for K-12 education abroad is rising

Perhaps the biggest push factor for affluent Vietnamese families with high-school-aged children is the tuition charged by international schools in their country: up to US$34,700 a year. A couple of quotes from parents interviewed for a 2022 article in the popular Vietnamese news portal VNExpress illustrate the depth of families’ frustration on this count:

“Even the famous Harvard demands only US$54,000/year. Anyone who sends his/her kids to such schools must be a fool. Money can buy many things, but never the intelligence.”

“A waste of money, more so if paid out of own pockets. Speaking of own experience having sent own kids to international schools (companies paid), a total rip-off. Many teachers at these schools are not even qualified to teach and kept moving on to the next country/adventure after a few years. If you have money to spend, better send your kids to really top schools abroad. Just a marketing gimmick preying on many rich parents looking to buy bragging rights or because their kids are not competitive enough in the local schools. These international schools really don't make your kids smarter.”

High international school fees in Vietnam equate to a rich recruiting ground for K-12 schools abroad. An IDP survey conducted in 2022 found that while undergraduate programmes remain the most popular option for Vietnamese students, the high school sector is growing the fastest.

Transnational providers enrol thousands of Vietnamese

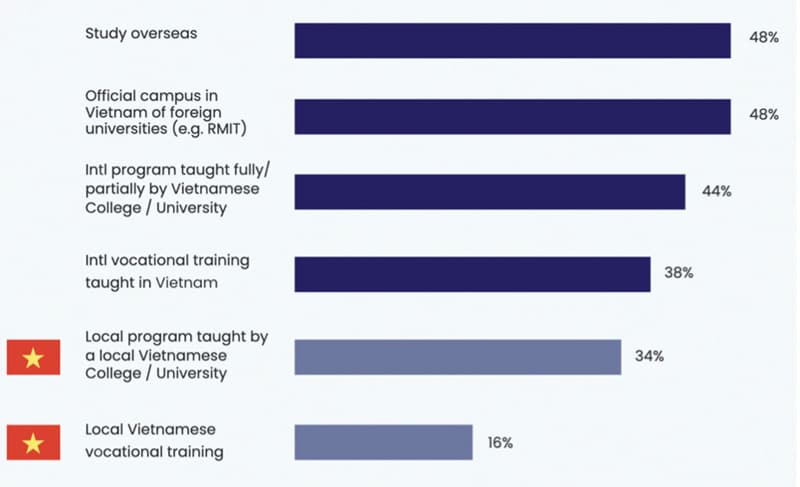

A 2023 survey by Acumen (under the Sannam S4 Group), whose 1,000 participants included high-income parents with students aged 8-22, found that 85% of parents were open to their children enrolling in TNE programmes (this rose in major cities compared to regions). Nearly half (48%) said they would prefer their children enrol in either overseas or TNE programmes compared to 34% who preferred local options.

Half of parents would pay up to US$8,400 per year for a TNE programme in Vietnam.

Acumen provided details on the scale of TNE in activity in Vietnam:

“There are more than 400 joint programmes approved between Vietnamese and international institutions, and 5 foreign invested campuses (including RMIT and British University Vietnam). At least 15,000 students are now studying Australian programmes in Vietnam, with the UK, US and New Zealand also offering many programmes.”

E-learning market potential is huge

Vietnam is among the top 10 fastest-growing markets for e-learning (20% from 2019–2023), and the market was valued at US$3 billion in 2021, up from US$2 billion in 2019. InCorp Vietnam reports that “Vietnam is host to 200 EdTech startups and is also among the top five countries receiving foreign investments in educational technology.”

According to Nguyen Thanh Nam, founder of FPT Online University (FUNiX), “Vietnam and some other countries like India, the Philippines and Mexico, which face major population pressure, have had to opt for e-learning to keep up with the education levels in developed countries.”

Demand for English-language learning is as high as ever

Vietnam is ranked 60 out of 111 countries in terms of English proficiency, according to EF Education First. Last year, the Vietnamese government made English a compulsory school subject for students in Grade 3-12, and has mandated that “all high schools, colleges and universities in Vietnam must have at least one foreign language and global integration club by 2030.”

But Vietnamese families aren’t waiting for their education system to catch up with the demand for English among employers, and ELT programmes abroad remain as popular as ever.

How do Gen Z Vietnamese make decisions about study abroad?

According to an INTO study conducted in 2022 among 1,000 Gen Z students and 500 parents in Vietnam, the top priorities for students considering higher education abroad were to improve English-language skills and enhance career prospects. Other major findings include:

- 4 in 5 students said their parents were the top influencers in their decisions about study abroad.

- Cost and safety were the top concerns of parents.

- Online content was the most important source of information, followed by discussions with university representatives and school counsellors.

- More than 9 in 10 participants also emphasised that agents/school representatives must engage with them face-to-face in addition to online.

- English-speaking countries are the major destinations considered by Vietnamese Gen Zs … but over half were considering a foreign degree from an Asian university as one of their top 3 choices.

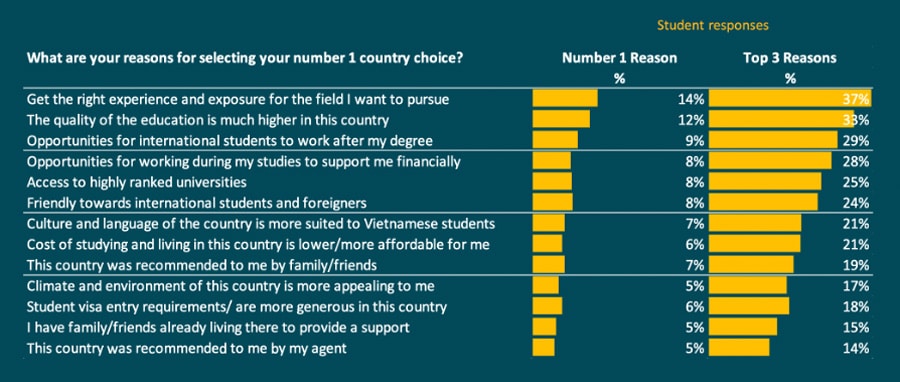

- The top priorities in terms of destination choice were (1) Get the right experience and exposure for the field I want to pursue, (2) The quality of the education is much higher in this country, (3) Opportunities for international students to work after my degree. The ability to work while studying was ranked #4 in terms of importance.

IDP research has found that in 2023, Canada is perceived to offer the most value of all destinations in terms of post-study work visa policies and post-graduate employment opportunities.

For additional background, please see: