Industry groups call for change as youth bookings for UK remain far below pre-COVID levels

- A major survey of agents who specialise in sending junior students to the UK for summer camps has found that group bookings in the junior category are down 83% from what they were in 2019

- Post-Brexit, EU students have required a passport and sometimes a visa to visit the UK, and agents say this is the main reason that business has declined so significantly

- An industry group is recommending that the government return to an arrangement where groups of students living in the EU could enter the UK under the “collective passport” of a group supervisor

A survey of more than 80 agents who book junior student groups for summer camps and other ELT programmes in Europe reveals that 83% fewer students in this category came to the UK in the summer of 2022 compared with the summer of 2019.

The survey was conducted by the Tourism Alliance, English UK, UKinbound, and the British Educational Travel Association (BETA), and the agents surveyed are collectively responsible for a significant proportion of all students travelling to the UK as part of a group led by a teacher or supervisor.

The decline is being felt throughout the British economy. Emma English, BETA’s chief executive, estimates the overall pre-COVID value of the youth and student travel market in the UK at £22.6 billion. More than three-quarters of UK language schools are located outside of London, and many are in struggling coastal towns.

Passports are at the root of the problem

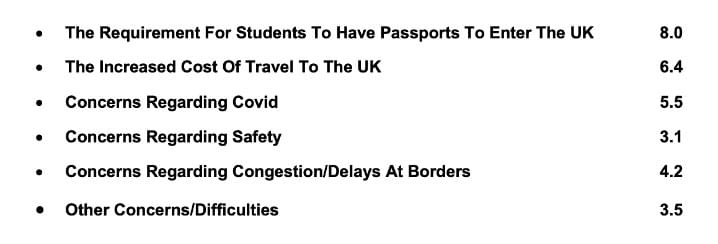

Agents said that the main reason for the drop in junior group bookings was the requirement for all students to have a passport – a rule that came into being after Brexit. Many EU students do not have a passport because they live in the Schengen zone (just 35% of students in the key Italian market do, for example); the UK’s requirement in this regard represents a hassle they don’t have to think of if they choose other destinations in the EU. The increased cost of travel to the UK was also an important barrier raised by agents.

Recovery is underway in other EU destinations

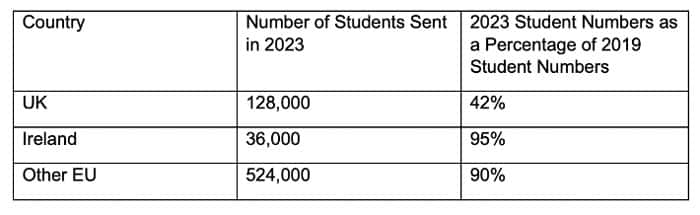

Agents reported smaller declines (-29%) in junior group bookings for Ireland and for other EU destinations (-32%), offering further proof that Brexit-related policies are hampering the ability of ELT providers in the UK to attract junior students and to recover from the business losses of the pandemic. These policies may also lead to the UK’s ELT sector losing share of the EU market through the next several years.

Huan Japes, acting joint chief executive of English UK, said that “Another complicating factor is the inclusivity requirement in many schools: if 10% of children cannot join a trip then it won’t go ahead. Putting all these things together, the impact is ‘let’s go elsewhere.’”

Richard Toomer, chief executive of the Tourism Alliance, said: “This is quite a simple policy matter… these are shocking findings we’re publishing today.”

Proposed: a new youth group travel scheme

To stop the downward trend, the Tourism Alliance and the Tourism Industry Council are urging the government to create a youth group travel scheme in which under-18s could enter the UK as part of a group led by a “passported leader.” This would be a “collective passport” for the group – an arrangement that would be very similar to how things operated before Brexit came to pass. Eligible students would be those who could prove they had a right to live in the EU (i.e., not just EU citizens).

The survey report authors had this to say about any potential risk to the UK that might be posed by such a scheme:

“There are no significant risks associated with developing a Youth Group Travel Scheme. Prior to the UK leaving the EU there was no evidence the List of Travellers Scheme was being abused as a route of entry into the UK. There is no evidence of school children ever being a security risk or leaving their school group to live and work in the UK.”

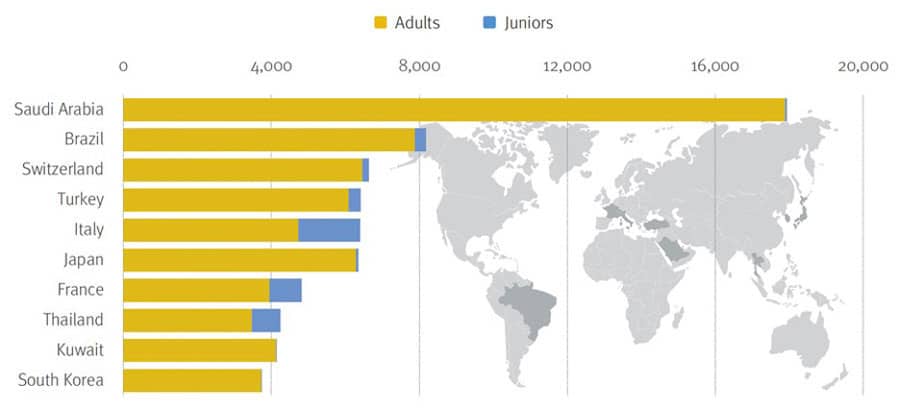

In 2019, just before the UK exited the EU, younger students made up more than half (54%) of the overall English-language training (ELT) market in the UK. The chart below, depicting 2022 data, shows how much this part of the business has shrunk: yellow reflects adults, while blue is juniors.

Massive economic impact

BETA’s Ms English said the drop in junior youth bookings equated to “£875m in revenue and a potential loss of 14,500 jobs.” The need for a policy intervention is underlined by the fact that just 13% of agents believe that the market will rebound in 2023. This is down from 23% of agents surveyed separately in June 2022. The report authors suggest that the increasing pessimism evident in the October survey may be linked to the cost-of-living crisis affecting many European countries as the war in Ukraine drags on.

Most agents responding to the October survey have finished their bookings for the summer of 2023, and unfortunately the near-term picture does not look excellent. Agents were asked how many students they will send to the UK and other destinations in 2023, and their responses are shown in the chart below. The report notes that these responses mean that, “in addition to the £875m loss in revenue to the UK economy this year, there will be a further £600m loss in revenue to the economy next year.”

Government says it is listening

Joss Croft, chief executive of UKInbound, who chairs the UK government’s tourism demand and competitiveness working group, said his group was “fully supportive” of the need for new policies to help struggling ELT providers, saying that the recovery of the ELT sector is in line with broader tourism recovery goals.

For additional background, please see: