Global survey shows that many language schools and agents will need to raise prices due to inflation

- An ALTO survey shows that most language schools and agents see no choice but to increase prices in 2023 as record-high inflation continues to drive up operating costs

- Not everyone is sure that their clients are prepared to pay increased fees

- The new challenge of inflation is yet another blow to an industry still reeling from the effects of the pandemic

Language schools and agents have been severely affected by the impacts of the pandemic over the past couple of years – losing students, staff, and revenue to the point where many have had to shut their doors. Now, they are also dealing with the effects of inflation. A new report from ALTO (The Association of Language Organisations), observes that “most schools and agents are in no condition to absorb or sustain any further losses” but that inflation is “pushing up staff costs, accommodation costs, and supplier costs.”

As a result, the pricing model for the industry is under considerable strain and the inevitable result is that agents and language schools will need to increase client fees in order to remain in business.

ALTO recently conducted a survey with 122 organisations (three-quarters of which were schools) to guide a planned “long term pricing project looking at ways to provide more flexibility within the international education industry and the way we interact with our partners.”

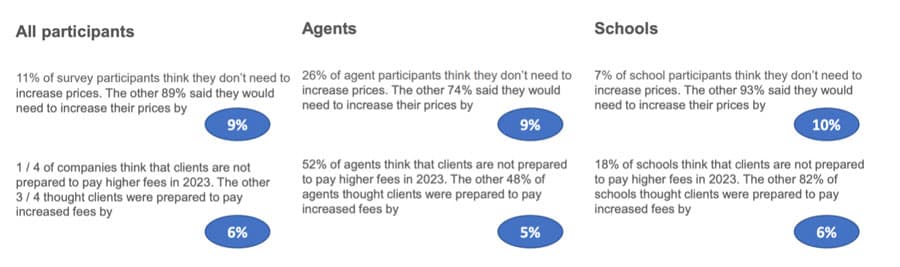

Vast majority expect they will need to increase their prices

Only a quarter of agent respondents thought they would not need to increase prices to cope with the new added challenge of inflation. Schools were less optimistic that they could hold prices to their current levels. Of agents and schools who thought they would need to increase prices, most thought they would have to raise them by about 10%.

More than half of agents did not think their clients would be prepared to pay higher prices in 2022. Of those who did think clients would be okay with a price hike, most thought they would only accept a 5% increase. School respondents were more confident that their clients would accept an increase, but again, there was a sense that clients would be prepared to pay less than what might be needed to keep the business solvent.

"The global inflation rate is pushing towards almost very close to double digits with a current average of 9% worldwide and this is even higher in countries like Turkey where the inflation rate has recently soared up to a staggering 73.5%," says Selim Dervish, the director of Academia United and an ALTO board member. "It is now becoming very clear that the market participants whether being on the sender or receiver end agree on the global inflationary pressures becoming a major issue both for their businesses but also for the sustainability of our industry as a whole."

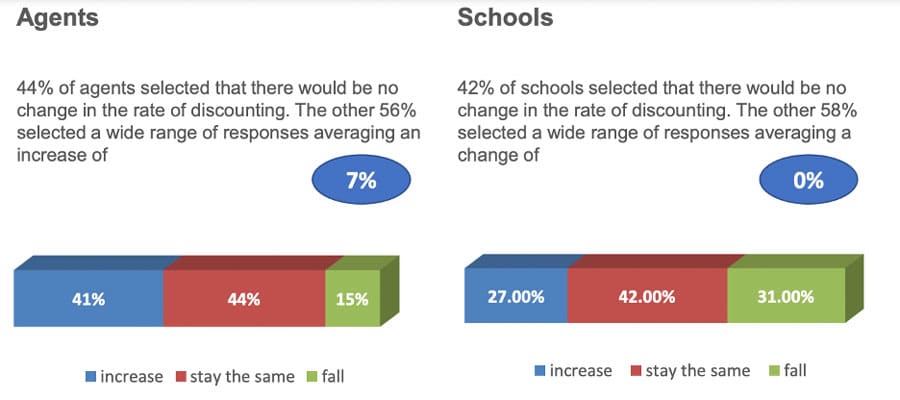

In terms of price discounting – a widely used tool in the industry – more than half of schools and agents said they anticipated a change in the rate of discounting they would be employing in 2023. Agents were more likely to say they would increase their discounting, while schools were more likely to predict that they would reduce their discounting.

The vast majority of schools and agents thought that homestay and residential fees would go up in 2023 by about 10%.

“Inflationary pressure has become a huge issue for education providers, and consequently for agents too,” says David Brown, president of Oxford International and also a member of the ALTO board. “For an industry that has struggled to accept significant price changes for the past two decades, we are now seeing schools needing to increase both course and accommodation costs by 10% and more just to retain margins. If inflation remains a problem for a longer period of time then we may need to find ways to adjust pricing on a more regular basis, particularly with accommodation providers struggling with spiralling energy costs.”

“ALTO hopes that the results of this survey will lead to ongoing discussions between all industry parties, to ensure that we all remain sustainable as organisations by having better control of our pricing strategies.”

The wider context

Many agents and schools’ operations fall into the category of “small businesses,” and their anticipation of passing on costs to clients are in keeping with trends in this category. A recent National Federation of Independent Business (NFIB) survey of more than 500 small business owners in the US that explored how these businesses are coping with inflation in 2022 found that more than two-thirds would increase prices in the next few months. Most anticipated a 4%–9% increase, while 40% thought they would have to raise prices by at least 10%. The NFIB noted that small businesses have “few other means at their disposal other than passing input costs on to consumers.”

High inflation could simply be the last straw for business owners – especially in the international education and travel industries that have been so impacted by the pandemic. They have been praised for being “nimble” and “resilient” and for “pivoting” but at a certain point there is only so much room to pivot. We can only hope that the pent-up demand for travel and study abroad is strong enough to withstand this latest challenge.

Experts interviewed for a recent article in Times Higher Education consider that Chinese students are less affected by inflation compared with already price-sensitive Indian students. In general, the consensus was that emerging markets for international educators are going to be hit the hardest by inflation and the rising fuel, food and energy costs caused by Russia’s invasion of Ukraine. Janet Ilieva, founder of Education Insight and an expert on global student mobility flows, said that “while it is very positive to see a surge in international student demand, it is mainly concentrated in price-sensitive countries.”

For additional background, please see: