US ELT numbers decline for third consecutive year

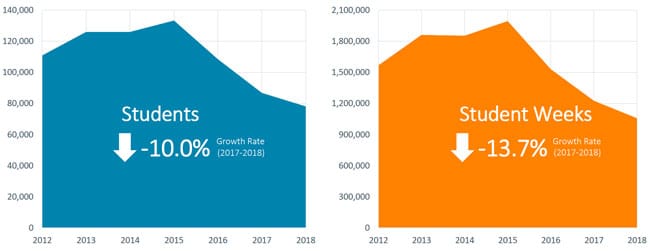

International enrolment in Intensive English Programmes in the US fell by 10% between 2017 and 2018 (and student weeks by 13.7%) according to the new data from the Institute of International Education (IIE) presented at the NAFSA conference in Washington, DC, last week. The data was collected via the IIE’s annual Intensive English Programme survey conducted among 400 IEPs (both those within higher education institutions as well as independent centres) throughout the US. In total, the survey finds that 78,100 international students studied intensive English for 1,057,650 student weeks in 2018.

Three years of decline, but decrease is less severe in 2018

The declines mark the third year of a downward trend in the US English-language training sector in the US. From a historic high point in 2015, IEP numbers in the US have declined by nearly 42% overall – and student weeks by 46% – through 2018.

- In Ireland, international student enrolments were down by 5% in 2018 after several years of steady increases. Despite the enrolments decrease, however, student weeks spent in Ireland’s English-language training centres reached a record high in 2018.

- In Malta, enrolments were flat in 2018 and student weeks fell by 12%. This is in contrast to the previous year’s results where there was a 15.5% increase in enrolments and a nearly 7% jump in student weeks.

- In South Africa, enrolments fell by 5% but student weeks increased by 5% in 2018. In 2017, there had been a 15% increase in enrolments and close to a 13% jump in student weeks.

- In the UK, 2018 was a lacklustre year for private-sector ELT centres, with enrolments growing by 1% and student weeks falling by 3%. In contrast, English-language training centres in UK colleges and universities saw enrolments jump by 10.5% and weeks grow by 11% (largely because the main sending market for these state centres, China, contributed 20% more weeks in 2018).

- In the most recent data released by Australia’s Department of Education and Training, which spoke to mid-2018 trends as opposed to full-2018 results, ELICOS (English Language Intensive Courses for Overseas Students) were looking at marginal growth over 2017. The longer-term picture, however, is that Australia has steadily gained market share since 2013.

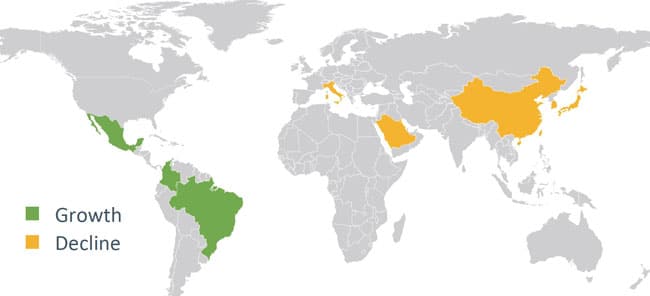

Latin America the only growth region

The number of Latin American and Caribbean students in US IEPs grew by 8% in 2018, but the remainder of sending regions sent fewer students. Asia sent -8% fewer students, Europe -9%, the Middle East and North Africa (MENA) -18%, and sub-Saharan Africa -21%.

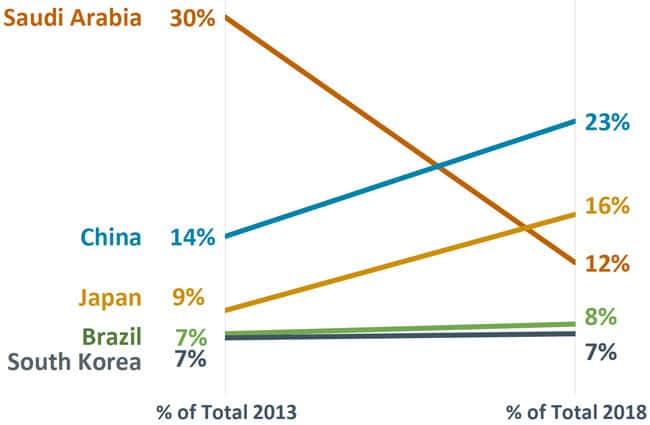

Main source markets

Two-thirds (66%) of students enrolled in US IEPs come from just five countries: China, Japan, Saudi Arabia, Brazil, and South Korea. The share of Saudi Arabian students studying in US IEPs has fallen from 30% five years ago to 12% in 2018 as a result of deep cuts beginning in 2015 to the King Abdullah Scholarship programme, which once funded thousands of Saudi Arabian students in the US. China’s share has moved from 14% to 23%, and Japan has also increased its contribution of students. Japanese students now make up 16% of the total compared with 9% five years ago.

- China: 17,700

- Japan: 12,305

- Saudi Arabia: 9,660

- Brazil: 6,155

- South Korea: 5,620

- Taiwan: 2,660

- Mexico: 1,975

- Colombia: 1,835

- Kuwait: 1,835

- Italy: 1,330

Reflecting the regional patterns we noted earlier, only the three top ten senders in Latin America demonstrated any enrolment growth last year. All other top ten sending markets declined in 2018.